Looking for Stellantis stock price prediction? You’re at the right place.

Stellantis NV is a global automotive company that merged with Fiat Chrysler Automobiles (FCA) and Groupe PSA in October 2021. The merger created the fourth-largest automaker in the world by volume, with a presence in more than 130 countries and a portfolio of 14 brands, including popular names such as Jeep, Ram, Dodge, Chrysler, Peugeot, Citroen, and Opel.

Regarding financial performance, Stellantis has reported strong results in the second quarter of 2022. The company reported a net income of $1.7 billion and a revenue of $39.2 billion. A strong increase in its market share, particularly in Europe and Latin America, was also reported.

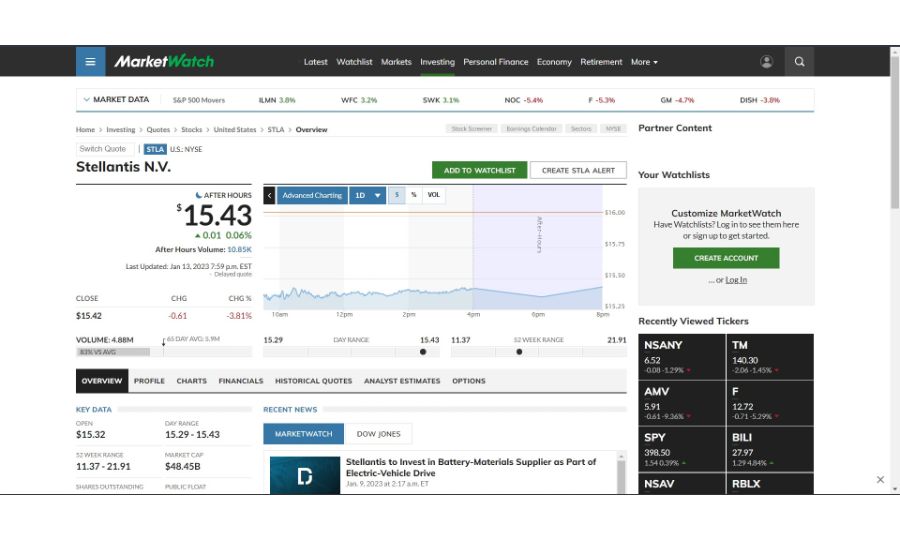

Stellantis Stock Price History

The initial public offering (IPO) price of Stellantis was $14 per share. After the first day of trading, the stock price closed at $15.85 per share, representing an increase of 13.2% from the IPO price. Since then, the stock price has fluctuated but overall has trended upward.

STLA stock was issued in October 2018; its highest end-of-day price was $24.81. Since then, the stock has seen a significant decrease and a peak of $15.45 in October 2021.

Stellantis Stock Price Prediction (2024-2060)

| Predicted Years | Minimum Price | Average Price | Maximum Price |

| 2024 | $17 | $19 | $21 |

| 2025 | $19 | $21 | $23 |

| 2030 | $29 | $31 | $33 |

| 2035 | $35 | $38 | $43 |

| 2040 | $41 | $47 | $56 |

| 2050 | $54 | $64 | $78 |

| 2060 | $75 | $85 | $95 |

Stellantis Stock Price Prediction 2024

In addition, the price of Stellantis may range from a high of $21 to a low of $17, with an expected average price of $19. There is also a good possibility that the price of a share of Stellantis stock may rise above the range of $21 by 2024.

Stellantis Stock Price Prediction 2025

According to market research, the price of a Stellantis stock in 2025 might range anywhere from $19 to $23, with a high of $23 being the most likely scenario. A greater price range and possibly even an all-time high could be reached in the market by 2025.

If the market is positive, there is also the possibility that the Stellantis price may rise to a level higher than this one. Furthermore, by 2025, it might have reached an average price of $21 and fluctuated around that price.

Stellantis Stock Price Prediction 2030

The price of Stellantis may hit its all-time high of $33 in 2030. If this occurs, it indicates that demand for this stock may grow by that year. Similarly, if there is a negative market in the year 2030, the price of a Stellantis stock may trade in the vicinity of $29, with an average price of $31.

Stellantis Stock Price Prediction 2035

As a result of market expansion, it is anticipated that the price of Stellantis’ shares may rise to a minimum price of $35 and a maximum price of $43 by 2035. There is a good likelihood that the market may achieve this with an average price of $32.25 if it continues to do well until 2030. If this occurs, the market may have reached its potential.

For 2040

The price of Stellantis in 2040 may hit an all-time high due to the tremendous expansion of the stock market. In addition, it might sell for as little as $41 or as much as $56 at its highest point. Therefore, you should anticipate an average price of $47 for the Stellantis stock.

Stellantis Stock Price Prediction 2050

2050 may be a pivotal year for Stellantis. And if so, its price might go as high as $78 or as low as $54 and settle somewhere between $64. If you hold onto the Stellantis stock for a longer period, you could be able to anticipate bigger returns.

Stellantis Stock Price Prediction 2060

In 2060, the price of a Stellantis stock might go as high as $95 or as low as $75, depending on market conditions. It is not easy to forecast the price of Stellantis in 2060, but based on the opinions of industry professionals, the price may rise above $95. Looking at the big picture, the average price of a Stellantis stock in 2060 might be $85.

FAQs

It is hard to say whether or not Stellantis NV is a good investment without considering an individual’s investment goals and risk tolerance. The merger of FCA and Groupe PSA has created a more diversified company with a broader range of products and a larger geographic reach which could lead to more revenue and profits in the long term.

Stellantis NV has had a promising start as a newly formed company and has a strong portfolio of brands, focusing on electric and sustainable vehicles, which are currently trending in the market.

Stellantis has a consensus rating of “Buy.” Also, analysts strongly believe that Stellantis can blow up in the future.

Final Words

Finally, we have discussed the Stellantis stock price predictions for different years. Stellantis NV is focusing on developing and launching new electric and hybrid models and expanding its global reach, particularly in Asia and Africa. Their expansion aligns with the increasing global trend toward electric vehicles and sustainability.

Useful Guides: